Summer Slump: Turkey’s Tourist Numbers Fall in June–July 2025

Turkey’s tourism boom hit a speed bump in the summer of 2025. After a record-breaking 2024, the country saw a noticeable dip in visitor numbers during June and July of 2025. Foreign tourist arrivals in June 2025 were down roughly 2.5% compared to June 2024, marking one of the few mid-summer declines Turkey has experienced since reopening global travel. Major destinations felt the pinch: in Antalya (the nation’s top “sun-and-sea” resort area), average hotel occupancy slipped to about 68.5%, a slight drop of 2.5 percentage points from the previous year. Istanbul’s hotels saw a similar mild downturn, with occupancy around 56.9% (down roughly 4 points). Even popular resort provinces like Muğla (home to Bodrum and Fethiye) hovered near the 50% occupancy mark. Local tourism boards described a “puzzling picture in the middle of summer” as some hotels in Alanya and other traditional beach towns remained emptier than expected. This mid-season softening stands in contrast to the robust growth Turkey enjoyed in 2022–2023 and has sparked questions about what went wrong – and how Turkey can bounce back.

Why Tourist Arrivals Dropped in 2025

Several factors converged to cool down Turkey’s tourism performance in early summer 2025. Industry analysts point to a mix of economic and environmental pressures, as well as shifting traveler habits, behind this downturn:

- Inflation and Rising Costs: Turkey’s high inflation has sharply increased the cost of travel and hospitality services. Hotels and restaurants, facing higher input costs, raised prices considerably in 2025. As a result, Turkey is no longer the bargain it once was. A five-day family vacation to Antalya or Bodrum now costs upwards of ₺150,000 (about €4,000–5,000) – comparable to a trip to Dubai – whereas similar holidays in Greece or Egypt cost barely half that in lira terms. This erosion of Turkey’s traditional price advantage has not gone unnoticed. Foreign visitors have complained that Turkey “has lost its price advantage,” causing some budget-conscious tourists to reconsider visiting. In short, steep inflation and a weaker lira drove up local prices so much that Turkey became as expensive as some Western European destinations, undermining one of its key draws.

- Higher Travel Expenses: In addition to local costs, the broader cost of traveling to Turkey increased. Airfares to Turkey remained elevated in 2025, influenced by global fuel prices and strong demand on many routes. Combined with pricier hotels and tours on the ground, the total expense of a Turkey trip climbed, leading some travelers to opt for cheaper destinations or shorter stays. Tour operators reported that tourists are more cautious and limiting their spending when in Turkey, a sign that value for money has become a concern.

- Climate and Extreme Heat: The summer of 2025 brought intense heat waves across Southern Europe, and Turkey was no exception. Sweltering temperatures and even wildfires in the region made headlines, raising safety concerns. In neighboring Greece, authorities temporarily closed the Acropolis to visitors during a July heat wave for health and safety reasons – a stark reminder of how climate conditions can disrupt tourism. Repeated heatwaves have begun to affect traveler behavior. A report by the European Travel Commission noted that many tourists are now actively avoiding the Mediterranean at the height of summer due to heat: Mediterranean destinations saw about a 10% drop in intent to travel in summer 2023, as more people looked instead to cooler climates like Northern Europe. By 2025, this trend of “traveling later or to milder destinations” persisted. Tourism analysts observed that more visitors are skipping peak summer in hot countries or shortening their outdoor activities, seeking evening tours, air-conditioned attractions, or traveling in spring or fall. The extreme heat has essentially made the traditional July–August beach holiday less appealing for some, contributing to stagnation in places like Turkey and Greece even as global travel rebounds.

- Competition from Other Destinations: Turkey also faced fiercer competition in 2025. Other countries in the region stepped up with attractive offers and had certain advantages. For instance, Spain and Italy recovered strongly and offered reliable summer experiences, while Greece and Egypt benefited from travelers seeking alternatives when Turkish prices soared. Notably, a substantial number of Turkish vacationers themselves chose to go abroad; there were reports of Turkish tourists flocking to nearby countries (like Greek islands) where they perceived better value. This outbound flow further dampened domestic tourism spending. In essence, Turkey’s neighbors and even long-haul destinations became viable substitutes, and Turkey’s tourism sector ceded some ground to these competitors due to the price and climate issues.

- Shifts in Tourist Preferences: The preferences of post-pandemic travelers continue to evolve in ways that affected Turkey’s summer season. There is a growing emphasis on value and quality – travelers want a great experience if they are paying more. Turkey’s recent spike in prices for even simple experiences (famously, a humble lahmacun flatbread in Bodrum hit exorbitant prices) sparked viral debates about whether the country is still hospitable for the average tourist. At the same time, there have been grumblings about service quality not keeping up with rising costs. Such perceptions can sway preference toward destinations seen as more “authentic and affordable.” Moreover, many tourists in 2025 showed a preference for exploring new or less crowded places. As Europe’s over-tourism concerns grow, travelers are diverting to lesser-known locales or traveling in off-peak times. This meant that some visitors who might have gone to Turkey’s mainstream resorts in July instead traveled in May or September, or chose smaller towns and countryside trips, diluting the peak-season crowds. All these subtle shifts – toward quality, authenticity, off-season, and off-the-beaten-path travel – collectively worked against Turkey’s big summer numbers in 2025.

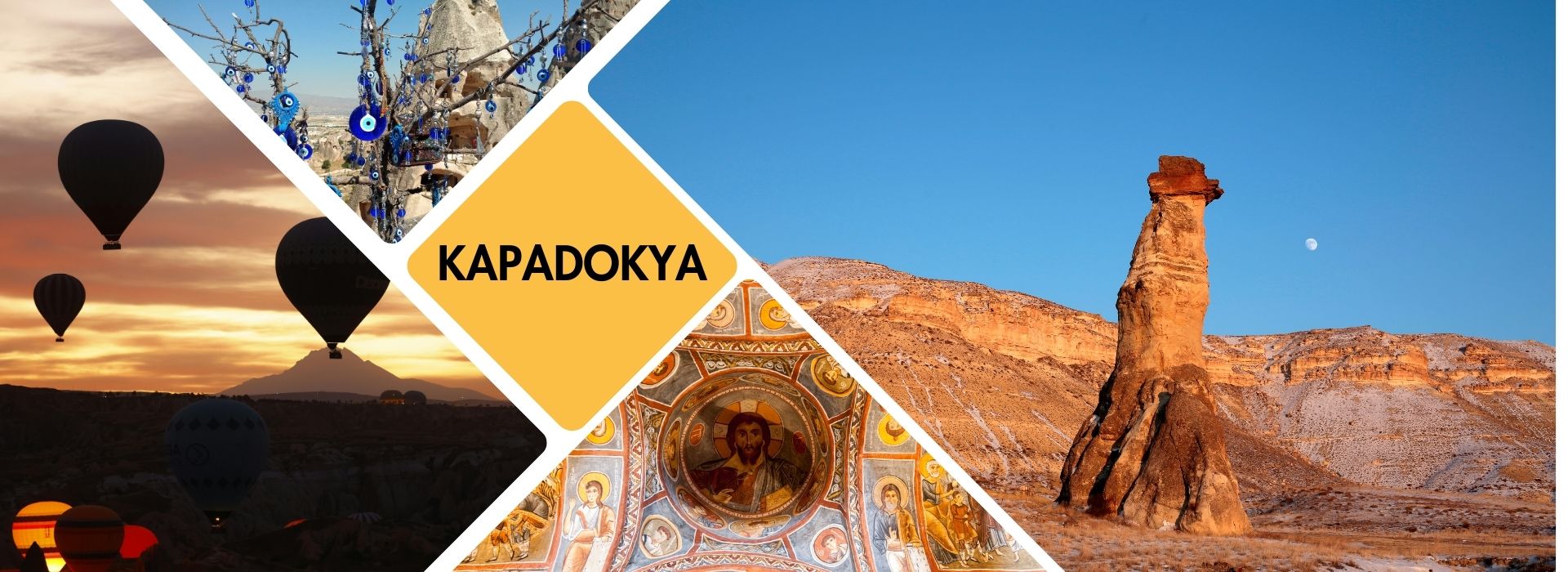

Cappadocia: A Bright Spot Amid the Slowdown

Colorful hot-air balloons rise above Cappadocia’s iconic fairy chimneys at sunrise. The region’s unique landscapes and cultural heritage continued to draw visitors, helping Cappadocia recover its tourist numbers in June 2025.

One region that defied the national dip was Cappadocia in central Turkey. Famed for its otherworldly fairy chimneys and sunrise balloon rides, Cappadocia actually saw a rebound in tourist activity in June 2025. In fact, June 2025 visitor levels in Cappadocia matched those of June 2023, essentially returning the region to its pre-slump performance. This recovery was thanks in part to a well-timed surge of visitors during the early-summer Eid holiday period. The Eid al-Adha holiday (a major public holiday in Turkey) fell in late June in 2023 and in the first half of June in 2025, bringing many domestic travelers and expatriate Turks into the Cappadocia area for vacation. During the extended nine-day Eid break at the end of June 2023, Cappadocia’s hotels were filled to 100% capacity and over 35,000 tourists arrived in just the first two days of the holiday. A similar holiday rush boosted Cappadocia in June 2025, filling cave hotels and tour slots with thousands of holidaymakers eager to explore the region’s cave churches, valleys, and take balloon flights. Local officials reported that the Ramadan/Eid week brought an influx of both Turkish and foreign tourists, briefly making Cappadocia one of the busiest spots in the country when elsewhere the season was slower.

However, outside of those holiday peaks, Cappadocia’s summer remained modest – as is usually the case. July is actually something of a shoulder season for Cappadocia, after the spring rush and before the autumn uptick. The region’s high semi-arid climate means July afternoons can be quite hot, discouraging some visitors from long hikes in the valleys. Additionally, many Turkish domestic tourists in mid-summer prefer seaside resorts over inland destinations. Consequently, Cappadocia’s July 2025 performance, while steady, was not spectacular – a typical pattern where the region catches up in early summer but does not necessarily boom in the height of summer. Industry observers note that Cappadocia’s strongest months tend to be spring and fall (when the weather is mild and ballooning conditions ideal), and that pattern held true in 2025. Still, the fact that Cappadocia held its own and even improved relative to 2024 in June is noteworthy. It underscores that unique cultural destinations can thrive even when mass-tourism resorts falter. The local Cappadocian tourism board, buoyed by the June results, maintained its expectation that 2025 could still be a “record-breaking year” for Cappadocia tourism, especially if the momentum carries into the fall season.

Global Tourism Trends: A Mixed Picture in 2025

Turkey’s summer slowdown did not occur in isolation – it came even as global tourism in 2025 was, overall, on the rise. Worldwide, travel demand has been growing as the last pandemic-related restrictions fade. In fact, international tourist arrivals were up about 5% in the first quarter of 2025 compared to the same period in 2024. This continued the recovery trend and even edged global travel closer to pre-2020 record levels. Not all regions shared equally in this growth, however. The strongest tourism surges have been in Asia-Pacific and Africa, where many destinations only fully reopened recently and are now catching up fast. Countries in Asia and the Pacific saw double-digit increases in visitors (over 12% growth early in the year), leading all regions. Africa also recorded robust growth, roughly +9% in arrivals, outpacing the global average. These regions benefited from pent-up demand and new airline routes reconnecting travelers to places like Southeast Asia, Japan, and various African nations that are trending in popularity.

Europe’s growth, on the other hand, has been relatively sluggish – and the Mediterranean area in particular has been almost flat in 2025. Southern European destinations including Turkey, Greece, Italy, and Spain have seen little to no growth in peak-season bookings (roughly 0–4% growth, much lower than the global rate). Industry reports pin this stagnation on rising prices and extreme weather. Simply put, a summer holiday on the Mediterranean has become pricier, and brutally hot, for many middle-class travelers. A UK-based survey found that concerns about heatwaves and climate change now influence vacation choices for a notable share of travelers. Many Europeans who traditionally flock to Mediterranean beaches in July are exploring alternatives – whether it’s traveling north for cooler weather or delaying trips to spring or autumn. At the same time, inflation in Europe means that domestic prices in Eurozone destinations have climbed, and the strong dollar (through 2024–25) made long-haul trips to places like the U.S. or Asia comparatively more appealing for some travelers than Europe. These global shifts help explain why Turkey and its Mediterranean neighbors faced a stagnating summer even as total worldwide travel kept climbing. As Bloomberg analysts quipped in July 2025, “the rational response to intense heat, high prices and overcrowding [in the Mediterranean] is to travel later in the year” – a trend that appears to be catching on.

Outlook: Turning Challenges into Opportunities

The summer of 2025 was undoubtedly challenging for Turkey’s tourism industry, but it also provided valuable lessons and highlighted areas of opportunity. As the year progresses into the autumn months, Turkish tourism officials and businesses are adopting a forward-looking mindset. There is cautious optimism that Turkey can rebound in late 2025 and into 2026 – if it pivots strategically. Here are a few key insights and strategies shaping the outlook:

- Focus on Quality and Value: With Turkey no longer a rock-bottom cheap destination, the emphasis is shifting to delivering high-quality service and experiences that justify the cost. Industry experts are urging measures to elevate service quality and preserve affordability to keep Turkey attractive. This could mean everything from improving hotel staff training, to adding more all-inclusive benefits, to curating unique cultural experiences that offer bang for the buck. By doubling down on hospitality and customer satisfaction, Turkey aims to ensure that visitors feel their money is well spent – and to distinguish itself from competitors. A satisfied tourist is more likely to return despite higher prices, whereas one who feels overcharged will not. The goal is to remind the world that Turkey offers a richness in history, cuisine, and natural beauty that few can match, especially if the experience is world-class.

- Diversifying Source Markets: The mid-2025 dip exposed the risks of over-reliance on a few markets like Russia or Germany (which saw declines this year). Moving forward, Turkey is actively courting a broader range of visitors. There have been notable upticks in tourists from the UK, Poland, and other European countries that helped offset some losses. Turkey plans to expand promotions in these growing markets and also farther afield – from attracting more Americans (a large tour operators’ meeting with U.S. travel companies was held in Cappadocia in 2025 to spark interest) to targeting Asian travelers as Asia-Pacific tourism booms. Additionally, the Turkish diaspora (citizens living abroad) proved to be a stabilizing force in 2025 – for instance, Turkish expats returning home propped up visitor counts in Antalya during summer. Encouraging diaspora visits and word-of-mouth marketing can further help fill hotels. By diversifying its tourist base across geographies and traveler segments, Turkey can become more resilient to any one country’s economic or political hiccups. Market diversification is now seen as “critical for maintaining the resilience” of Turkey’s tourism sector.

- Climate-Sensitive Planning: The writing is on the wall that extreme heat and climate events will be a recurrent challenge. Turkish tourism authorities are beginning to adapt by developing climate-sensitive tourism strategies. This includes promoting travel to cooler regions of Turkey (like the Black Sea highlands or eastern mountains) during peak summer, improving heat management at sites (more shading, adjusted opening hours like Greece did, etc.), and heavily marketing the spring and fall seasons as ideal times to visit. If summer heat keeps many travelers away at the last minute, Turkey aims to capture those visitors either earlier or later in the year. The Tourism Ministry has already been highlighting year-round offerings – for example, cultural festivals in the cooler months and winter tourism in ski resorts – to spread demand beyond the scorching months. Sustainable tourism initiatives are also underway, aligning with global trends. By planning with the climate in mind, Turkey can both protect tourists (as seen with heat precautions) and persuade them that Turkey remains a viable destination even as summers get hotter. Over the longer term, success in this area will involve close coordination with weather services, investment in infrastructure (like cooling systems or fire prevention) at tourist sites, and maybe even reimagining the peak “summer season” concept altogether.

Looking ahead to the rest of 2025 and into 2026, Turkey’s tourism sector remains a heavyweight and is far from defeat. Yes, the lofty official target of attracting 65 million visitors in 2025 may need to be tempered if current trends continue, but Turkey is still on track to welcome tens of millions of travelers and earn tens of billions in revenue this year. The foundations of Turkey’s appeal are still strong – from its rich heritage and cuisine to its beaches and unique landscapes – and these fundamentals give it the capacity to recover. By learning from this summer’s setbacks and implementing proactive measures (enhancing quality, diversifying markets, and adapting to climate realities), Turkey can turn a short-term slowdown into long-term sustainability. Tourism analysts note that the sector is cyclical; a soft year can be followed by a strong one if adjustments are made. With the global travel outlook remaining positive and new visitor segments on the horizon, Turkey could well see a healthier tourism picture in late 2025 and a resurgence in 2026. In the words of one industry insider, “Turkey has faced challenges before and bounced back by reinventing itself – expect no less this time.” With resilient regions like Cappadocia leading by example and a renewed commitment to excellence, Turkey’s tourism story for the coming years looks ready to take flight once again, brighter and smarter than before.

Sources: Recent tourism reports and news analyses were used in compiling this overview, including official Turkish tourism statistics and industry commentary on the 2025 season, as well as global travel trend data from the UN World Tourism Organization and European Travel Commission. Local Turkish media insights on regional tourism (e.g. Cappadocia and Alanya) were also referenced to illustrate on-the-ground conditions. These sources collectively portray the nuanced picture of Turkey’s tourism performance in mid-2025 and informed the forward-looking strategies discussed.